Car insurance policies often come with various coverage options, but what happens when you accidentally fill your tank with the wrong fuel? This scenario can be a costly mistake, and many drivers wonder if their insurance will cover the damages. Understanding the nuances of insurance coverage for such incidents is crucial for any vehicle owner. In this paragraph, we'll explore the common questions and concerns regarding insurance coverage for wrong fuel incidents, providing insights into how insurance companies typically handle these claims and what policyholders can expect in terms of financial protection.

| Characteristics | Values |

|---|---|

| Policy Type | Comprehensive, Third-Party, Third-Party Fire and Theft |

| Coverage | May cover costs associated with draining the wrong fuel, repairing damage caused by the wrong fuel, and towing the vehicle to a repair shop |

| Exclusions | Some policies may exclude coverage for vehicles with modified fuel systems or those that have been tampered with |

| Claims Process | Contact your insurance provider immediately, provide details of the incident, and follow their instructions for filing a claim |

| Fuel Type | Coverage can vary depending on the type of fuel used (e.g., gasoline, diesel, biofuel) |

| Vehicle Age | Age of the vehicle may impact coverage, with older vehicles potentially having different terms |

| Provider Policies | Each insurance company may have specific guidelines and exclusions, so it's essential to review your policy |

| Emergency Assistance | Some insurers offer roadside assistance services, including help with wrong fuel situations |

| Deductibles | You may need to pay a deductible before the insurance coverage kicks in |

| Time Limits | There might be time restrictions on when you can file a claim after the wrong fuel incident |

What You'll Learn

- Fuel Type Coverage: Check if your policy covers different fuel types, including diesel, petrol, and biofuels

- Fuel Contamination: Understand if contamination or wrong fuel is considered an accident or a separate issue

- Fuel Delivery Services: Explore if insurance covers fuel delivery services and their potential risks

- Fuel Pump Malfunction: Determine if a malfunction at the fuel pump is covered as a mechanical failure

- Fuel System Damage: Assess the extent of damage coverage for the fuel system, including pumps and injectors

Fuel Type Coverage: Check if your policy covers different fuel types, including diesel, petrol, and biofuels

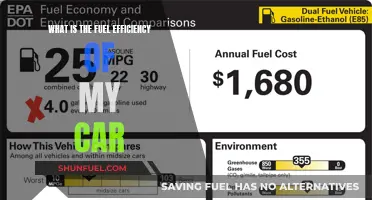

When it comes to car insurance, understanding the coverage for different fuel types is crucial, especially if you're a driver who regularly uses various fuels like diesel, petrol, or biofuels. The 'Fuel Type Coverage' aspect of your insurance policy is a critical detail that can significantly impact your claims process if you accidentally fill your tank with the wrong type of fuel.

Many standard car insurance policies do not automatically cover the costs associated with using the wrong fuel. This means that if you mistakenly fill your diesel car with petrol, or your hybrid vehicle with a biofuel, you might be left with a hefty bill. The insurance company typically expects you to use the correct fuel type as specified in your vehicle's manual. Therefore, it's essential to review your policy documents to understand what is covered.

To ensure you're adequately protected, contact your insurance provider and inquire about their policy on fuel type coverage. Some insurers may offer specific add-ons or extensions to their policies to cover such incidents. For instance, comprehensive insurance often includes coverage for accidental fuel contamination, which can be beneficial if you're concerned about the potential risks of using the wrong fuel.

Additionally, it's a good practice to familiarize yourself with your vehicle's fuel system and the types of fuel it can accommodate. Modern vehicles are designed to handle different fuels, but using the wrong one can still lead to engine damage or performance issues. Always refer to your car's manual for guidance on the appropriate fuel type and quantity.

In summary, checking the 'Fuel Type Coverage' in your car insurance policy is essential to avoid unexpected costs. Being proactive and informed about your vehicle's fuel requirements can help you navigate the complexities of insurance coverage and ensure you're prepared for any fuel-related incidents.

E85 Fuel: Unleash Your Car's True Potential?

You may want to see also

Fuel Contamination: Understand if contamination or wrong fuel is considered an accident or a separate issue

When it comes to fuel contamination, it's important to understand the distinction between an accident and a separate issue. In the context of car insurance, accidents typically refer to unforeseen events that result in damage or loss. However, fuel contamination, which occurs when the wrong type of fuel is accidentally added to a vehicle's tank, is often considered a separate issue. This is because it is not an accident in the traditional sense but rather a mistake or error in judgment.

The primary reason for this classification is that fuel contamination is often preventable. It happens when a driver mistakenly fills their tank with the wrong type of fuel, such as gasoline in a diesel engine or vice versa. This mistake is usually due to human error, such as misreading the fuel nozzle or not paying attention to the fuel type specified for the vehicle. While these errors can lead to significant damage to the engine and other vehicle components, they are not considered accidents in the same way that a collision or sudden mechanical failure might be.

Car insurance policies often have specific clauses addressing fuel contamination. Some insurers may cover the costs associated with the contamination, such as the removal of the wrong fuel and any necessary repairs, but they may not provide coverage for the damage caused by the contamination itself. This is because the contamination is seen as a result of the policyholder's mistake, and insurance companies generally do not cover losses that could have been avoided through reasonable care and attention.

Understanding this distinction is crucial for vehicle owners to manage their insurance claims effectively. If fuel contamination occurs, it is essential to act promptly and seek professional assistance to minimize further damage. Additionally, reviewing your insurance policy and understanding its terms regarding fuel-related issues can help you navigate such situations with clarity and confidence.

In summary, fuel contamination is generally not considered an accident but rather a separate issue caused by human error. This classification impacts how insurance companies handle claims related to fuel contamination, emphasizing the importance of prevention and prompt action to mitigate potential losses.

Fuel Filter Issues: Why Your Car May Stall

You may want to see also

Fuel Delivery Services: Explore if insurance covers fuel delivery services and their potential risks

The concept of fuel delivery services has gained popularity, especially in urban areas where access to fuel stations might be limited or inconvenient. These services offer a convenient way to refuel vehicles, often delivering fuel directly to the customer's location. However, like any service, it's essential to understand the potential risks and coverage implications for both the service provider and the customer.

When it comes to insurance coverage for fuel delivery services, the answer is not straightforward. Standard car insurance policies typically do not cover fuel delivery services, as they are considered a convenience rather than a necessity. Most insurance companies have specific exclusions for fuel-related incidents, including fuel delivery. This means that if something goes wrong during the fuel delivery process, such as a spill, contamination, or incorrect fuel type, the insurance might not provide coverage.

The potential risks associated with fuel delivery services are numerous. Firstly, there is a risk of fuel contamination or incorrect fuel type being delivered. This can lead to engine damage or performance issues, especially if the wrong fuel is added to a vehicle's tank. Secondly, fuel delivery services involve handling and transporting fuel, which can pose a fire hazard if not managed properly. Additionally, there is a risk of property damage if fuel spills during the delivery process.

To mitigate these risks, fuel delivery companies often have their own insurance policies tailored to their specific needs. These policies may cover incidents related to fuel delivery, providing financial protection against potential losses. However, it's crucial for customers to understand that their standard car insurance might not be sufficient to cover any damages or incidents related to fuel delivery.

In summary, while fuel delivery services offer convenience, it is essential to be aware of the potential risks and insurance coverage limitations. Customers should consider the specific terms and conditions of the fuel delivery service and potentially obtain additional insurance coverage if they wish to protect themselves against unforeseen events.

Mazda's Fuel Efficiency: A Comprehensive Guide to Eco-Friendly Driving

You may want to see also

Fuel Pump Malfunction: Determine if a malfunction at the fuel pump is covered as a mechanical failure

A fuel pump malfunction can be a frustrating and costly issue for vehicle owners, often leaving them wondering about the coverage options provided by their insurance policies. When it comes to determining if a fuel pump failure is covered as a mechanical failure, it's essential to understand the specific circumstances and the insurance policy's terms.

Mechanical failures are typically covered under comprehensive car insurance policies, which offer protection against various non-collision-related incidents. A fuel pump malfunction can indeed be considered a mechanical failure, especially if it is due to internal wear and tear, manufacturing defects, or other mechanical issues. However, it's crucial to note that not all fuel pump problems are automatically covered. The insurance company will investigate the cause of the malfunction to assess whether it falls under the policy's definition of a mechanical failure.

In many cases, fuel pump issues arise from external factors, such as contamination or improper fuel usage (e.g., adding the wrong fuel type). These instances are generally not covered as mechanical failures. For example, if a driver mistakenly fills their tank with diesel instead of gasoline, the resulting fuel pump damage is typically considered a result of the wrong fuel, which is usually excluded from insurance coverage.

To determine coverage, insurance companies often require proof of the fuel pump's proper functioning before the incident. This may involve providing service records, fuel purchase receipts, or expert testimony. It is advisable for policyholders to review their insurance policy documents thoroughly and contact their insurance provider directly to understand the specific coverage details and requirements in the event of a fuel pump malfunction.

In summary, while a fuel pump malfunction can be a covered mechanical failure under comprehensive car insurance, the specific circumstances and the insurance company's investigation play a crucial role in determining eligibility for coverage. Policyholders should be aware of the potential causes of fuel pump issues and the policy's terms to navigate such situations effectively.

Flex Fuel Cars: Are They Still Around?

You may want to see also

Fuel System Damage: Assess the extent of damage coverage for the fuel system, including pumps and injectors

When it comes to car insurance, one of the most critical aspects to consider is the coverage for fuel system damage, especially when it occurs due to the wrong fuel being used. The fuel system, comprising pumps, injectors, and other components, is a complex and vital part of your vehicle's engine. Understanding the insurance coverage for such damage is essential to ensure you're not left with unexpected financial burdens.

In the event of a wrong-fuel incident, the damage to the fuel system can vary widely. It might range from minor issues, like a clogged fuel filter, to more severe problems, such as damaged fuel pumps or injectors. The severity often depends on the type of fuel used, the engine's design, and the duration before the incorrect fuel is realized and addressed. For instance, using diesel in a gasoline engine can lead to rapid and extensive damage, while a small amount of gasoline in a diesel engine might cause less immediate harm but could still result in long-term issues.

Car insurance policies typically have specific clauses addressing fuel-related damage. Some policies may offer comprehensive coverage that includes fuel system damage, while others might have exclusions or limitations. It's crucial to review your policy or consult your insurance provider to understand the extent of your coverage. Many standard policies do not cover fuel system damage caused by using the wrong fuel, as this is often considered a preventable incident. However, some insurers might offer additional coverage or endorsements to address this specific risk.

If you're considering purchasing additional coverage, it's essential to discuss the options with your insurance agent. They can help you assess the potential risks and benefits of adding fuel system damage coverage to your policy. This might be particularly important for vehicle owners who frequently travel to areas where fuel type availability could be a concern.

In summary, while standard car insurance may not always cover fuel system damage caused by wrong-fuel incidents, it's a critical aspect of vehicle ownership to understand your policy's specifics. Being proactive and informed can help you manage the financial risks associated with such damage, ensuring you're prepared for any unexpected engine issues.

Unraveling the Mystery: Sudden Fuel Efficiency Drop in Cars

You may want to see also

Frequently asked questions

Generally, car insurance policies do not cover the cost of using the wrong fuel. This is considered a driver's responsibility, and the insurance company typically views it as a preventable incident. The policyholder would need to bear the expenses associated with using the incorrect fuel type.

In the event of accidental wrong-fuel usage, it's important to act quickly. Contact your insurance provider immediately and inform them of the situation. They may provide guidance on the next steps, which could include draining the wrong fuel, seeking professional assistance, and filing a claim if the damage is significant.

Yes, there might be some exceptions depending on the insurance policy's terms and conditions. For instance, some comprehensive insurance policies may offer coverage for accidental fuel contamination or engine damage caused by the wrong fuel. It's essential to review your policy or consult your insurance agent to understand the specific coverage.

To avoid such incidents, always refer to your vehicle's owner's manual for fuel type recommendations. Double-check the fuel nozzle and ensure you're fueling the correct type. If you're ever in doubt, contact a mechanic or a trusted garage for advice. Being cautious and informed can help prevent costly mistakes and potential insurance claims.